This week os a pessimistic week for The Economist. For all the optimism Technology Quarterly brings, it’s the economic doubt raised about Beijing’s role in the world, warnings about the evolution of the internet, and anthropogenic global warming, that is most compelling.

This week os a pessimistic week for The Economist. For all the optimism Technology Quarterly brings, it’s the economic doubt raised about Beijing’s role in the world, warnings about the evolution of the internet, and anthropogenic global warming, that is most compelling.

-

Of course, companies have long mined their data to improve sales and productivity. But broadening data mining to include analysis of social networks makes new things possible. Modelling social relationships is akin to creating an “index of power”, says Stephen Borgatti, a network-analysis expert at the University of Kentucky in Lexington. In some companies, e-mails are analysed automatically to help bosses manage their workers. Employees who are often asked for advice may be good candidates for promotion, for example.

-

But Than Shwe himself remains a mystery: not least because few people seem to think him very bright. His tactical nous and staying power have been consistently underestimated, perhaps because of the consensus characteristic that emerges from Mr Rogers’s biography: in the words of a Western diplomat whom he quotes, Than Shwe is “a bit of a thug”.

The dream is that this gilded future is now insulated from rich-world downturns: that China—now having, after all, officially overtaken Japan as the world’s second-largest economy—can drive growth for the whole region. One day, maybe. Not yet.

That the idea has currency at all reflects a remarkable transformation in itself. During the East Asian financial crash of the late 1990s, many in the region blamed China as a proximate cause of the debacle. Its emergence as a big competitor, the argument went, stalled the rapid export growth on which countries such as Thailand had come to depend, poking large holes in their current accounts, and precipitated the collapse of confidence.

Since then, and especially since the surge that followed its accession to the WTO in 2001, China’s economic clout has grown as fast—or faster—in its own region as anywhere. And with East Asia, unlike with Europe and America, China tends to run trade deficits. It is now the biggest trading partner for both Australia and India. It is the biggest export market for Japan, South Korea and Taiwan; the second-biggest for Malaysia and Thailand; the third-biggest for Indonesia and the Philippines, and so on.

(…)

Still, few are yet confident in the “golden age”. People’s Daily used the term in reporting the views of “many” taking part in the “Sixth Beijing-Tokyo Forum” in Tokyo. It seems unlikely the many included the Japanese contingent. The economic news at home was worrying—though it would have been grimmer still were it not for the healthy growth in recent years in exports to China. In this context, the report read rather like a young sports champion consoling the veteran whom he has just bested.

Even in much of young, vigorous developing Asia the boom seems too precarious for triumphalism. One reason for this is statistical. Growth figures in parts of Asia have been so spectacularly good partly because they were so spectacularly bad in the first half of 2009. Singapore’s extraordinary first-half GDP growth of 17.9% looks slightly less otherworldly against last year’s first-half contraction of 5.3%. In the depth of the crisis, as trade for a while seized up, the region, as one of the most trade-dependent in the world, saw growth plummet.

That trade dependence is another reason for sobriety. Outside of China and India (which this week reported 8.8% second-quarter growth compared with a year earlier), developing Asia remains heavily dependent on external demand. And despite the heady growth of sales to China, the most important sources of demand remain the “G3” of America, Europe and Japan.

Asian exports to China fall broadly into three categories. Industrialised countries, notably Japan and South Korea, have found a big market for capital goods. Countries such as Australia and Indonesia have fed China’s growing appetite for commodities and raw materials such as coal, iron ore and palm oil. But many Asian exporters have been selling components, as part of globalised supply chains in which “made in China” often means “assembled in China from bits produced all over the place”.

It is hard to work out from published trade figures where components imported to China from, say, Malaysia, end up. But Malaysian officials believe that some 60% of their exports to China are destined for the G3. (By contrast, less than 30% of Indonesia’s exports to China are re-exported.) A recent study of such “global production sharing” in East Asia by the Asian Development Bank (ADB) concluded that it has played a pivotal role in the region’s dynamism and growing interdependence. But it has not lessened the region’s dependence on the global economy.

Other studies have also found that China has already had quite a big positive impact on growth in other countries in the region. Besides providing an export market, it is a source of tourists, investment opportunities and demand for services. And, less measurably, it is a source of economic optimism: a boost to consumer and business sentiment.

Its economy, however, for all its three-decades-long boom, still only accounts for 8% of global GDP in current dollars; domestic private consumption, though growing fast, remains a small part of national GDP by global standards (36%). This will grow as China reforms its economy to give a bigger share to household income, for example by lifting wages for China’s factory workers. On August 29th Wen Jiabao, China’s prime minister, must have enjoyed lecturing Japanese visitors on the need to tackle the problem of “relatively low wages” at Japanese factories in China.

This “rebalancing”, though, could take decades. In the short term the high-speed growth much of the rest of the region has enjoyed will moderate. Growth will not be measured against the worst of the slump; and faltering recovery in the G3 will dent exports, however well China does. The golden age is not here yet.

Three sets of walls are being built. The first is national. China’s “great firewall” already imposes tight controls on internet links with the rest of the world, monitoring traffic and making many sites or services unavailable. Other countries, including Iran, Cuba, Saudi Arabia and Vietnam, have done similar things, and other governments are tightening controls on what people can see and do on the internet.

Second, companies are exerting greater control by building “walled gardens”—an approach that appeared to have died out a decade ago. Facebook has its own closed, internal e-mail system, for example. Google has built a suite of integrated web-based services. Users of Apple’s mobile devices access many internet services through small downloadable software applications, or apps, rather than a web browser. By dictating which apps are allowed on its devices, Apple has become a gatekeeper. As apps spread to other mobile devices, and even cars and televisions, other firms will do so too.

Third, there are concerns that network operators looking for new sources of revenue will strike deals with content providers that will favour those websites prepared to pay up. Al Franken, a Democratic senator, spelled out his nightmare scenario in a speech in July: right-wing news sites loading five times faster than left-wing blogs. He and other advocates of “net neutrality” want new laws to stop networks discriminating between different types of traffic. But network operators say that could hamper innovation, and those on the right see net neutrality as a socialist plot to regulate the internet.

Thus the incentives that used to favour greater interconnection now point the other way. Suggesting that “The Web is Dead”, as Wired magazine did recently, is going a bit far. But the net is losing some of its openness and universality.

(…)

But that is not the case in America. Its vitriolic net-neutrality debate is a reflection of the lack of competition in broadband access. The best solution would be to require telecoms operators to open their high-speed networks to rivals on a wholesale basis, as is the case almost everywhere in the industrialised world. America’s big network operators have long argued that being forced to share their networks would undermine their incentives to invest in new infrastructure, and thus hamper the roll-out of broadband. But that has not happened in other countries that have mandated such “open access”, and enjoy faster and cheaper broadband than America. Net neutrality is difficult to define and enforce, and efforts to do so merely address the symptom (concern about discrimination) rather than the underlying cause (lack of competition). Rivalry between access providers offers the best protection against the erection of new barriers to the flow of information online.

Rare earths have become increasingly important in manufacturing sophisticated products including flat-screen monitors, electric-car batteries, wind turbines and aerospace alloys. Over the summer prices for cerium (used in glass), lanthanum (petrol refining), yttrium (displays) and a bunch of other –iums have zoomed upward (see chart) as China, which accounts for almost all of the world’s production, squeezes supply. In July it announced the latest in a series of annual export reductions, this time by 40% to precisely 30,258 tonnes. That is 15,000-20,000 tonnes less than consumption by non-Chinese producers, says Judith Chegwidden of Roskill Information Services, a consultancy.

China has cited “environmental” concerns as the reason for the export quotas. That is less implausible than it sounds. Rare earths are dangerous and costly to extract responsibly; China’s techniques have been anything but. It has deposits in two regions: Inner Mongolia, where rare earths are a by-product of iron-ore production, and in the south of the country, where they are found in various clays. Although the extraction process in each location differs, they share a need for highly toxic chemicals. Horror stories abound about poisoned water supplies and miners.

But since the spike in rare-earth prices seems not to have taken hold within China, many see another, more nefarious calculation behind the export quotas. Controlling the supply of rare earths means that China can also control their processing and use in finished goods, which would fit a broader effort to drive its manufacturers from low- to high-value goods.

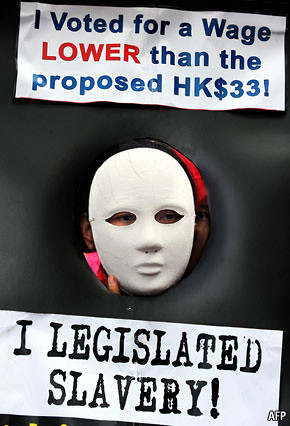

Hong Kong doesn’t offer a large consumer market, as China does, or low production costs, or even clean air. What it has traditionally offered is simplicity. Businesses can start, operate and grow with minimal interference from the state. That is why this speck of rock is rich.

Backers of the minimum wage hope that it will be followed with other rules, such as caps on working hours. With each new rule, businessfolk fear, doing business will become a little more cumbersome. Some firms will grow more slowly. Others will never start.

If this week’s report into the workings of the Intergovernmental Panel on Climate Change (IPCC) by a council of national academies of science were the sort of report children take home from school, its main themes would be expressed as “could do better” and “needs to show workings”. Stern parents might read it as calling for a Gradgrind-like clampdown; more indulgent ones as an inducement for the little darlings to try a little harder.

At a meeting in Busan, South Korea, this October, the parents in question—the representatives of the IPCC’s member governments—will decide which sort they want to be. Read in detail, the report suggests that if they want credible climate assessments, a firm hand will be required.

China’s president, Hu Jintao, wished the party meeting in Pyongyang a “signal success”. The Chinese media played up Mr Kim’s reported agreement with his hosts on the need for an “early resumption” of multinational talks on North Korea’s nuclear programme. Prospects for this remain dim, but some analysts believe that North Korea might try to get negotiations restarted as a way of relieving economic pressure. For the moment, China is North Korea’s lifeline. Diplomats say trade between the two countries has picked up in recent months. In return for food, North Korea has given China a new lease on harbour facilities in the north-eastern port of Rajin.

The prospect of a power transfer in Pyongyang worries China. Global Times, an English-language newspaper in Beijing, accused America and South Korea of wanting to “create turmoil” in North Korea and said a smooth transition there was “vital” for stability in north-east Asia. Victor Cha of the Centre for Strategic and International Studies, a Washington think-tank, says that Mr Kim’s mysterious visit at least made it clear that China would stick with its ally to “the bitter end”.

South Koreans are unsure precisely how best to respond to the uncertain changes in the regime to the North. A hardline approach to its neighbour has been the official stance ever since the Cheonan, a Southern military corvette, was torpedoed in March. Sanctions, a diplomatic freeze and military exercises with the Americans all suggest that the authorities in Seoul are in no mood to back down.

Yet this week, the South Korean Red Cross said that it would send emergency aid, mostly food and medicine, worth $8.4m to help the North cope with floods. This would be the first aid to flow north since May, but the South’s government insists it is merely a temporary humanitarian measure.

It is still harder to know what to make of a more eccentric offer of a sporting olive branch. An ex-foreign minister and diplomat in the South has proposed that the two Koreas should collaborate in a bid to host the football World Cup. Han Sung-joo, who chairs a committee seeking the return of the event to South Korea in 2022, wants the North to host some matches. He denies an official joint approach is in the works, but suggests that four games could be played north of the 38th parallel, perhaps in Pyongyang’s cavernous May Day stadium. The North has yet to say if it is keen.

Powered by ScribeFire.

Filed under: Business/Economy, East Asia, Korea, Link Dumps, Subscriptions, TV Tagged: china, fprk, Global warming, hong kong, internet, ipcc, Korea, myanmar, prc, rare earths, rok, social networking, than shwe, the economist

Recent comments